Working for money is only a small part of the process of creating money. There are many parts involved in riding a bicycle. Working is like pedalling. It is an important part, but there is much more involved. If all you know is how to pedal, you’re destined to fall on your face. Unfortunately, most people think pedalling is all there is to riding a bike, so they are pedalling harder and harder but getting nowhere. They aren’t learning how to balance or steer. If they are staying upright at all, it is only because they’ve taken to riding one of those stationary exercise bikes, where you pedal like mad but stay firmly planted in one place.

Everyone who works with our company is constantly refining their abilities to create money, not simply waiting for a paycheck. We are more than a business; we are also a school. The people who work with us are training to be generalists in business and can swap places with anyone throughout our organisation. We are constantly training everyone associated with us to be generalists in business. And although we have a few strict rules and policies, everyone is encouraged to experiment, to make mistakes, correct them and report their findings at our meetings. Our business is always growing. All of us are continuously learning and changing. It is definitely not a boring place to work in, believe me! Here’s something else I’d like to point out: there is no such thing as a crazy idea in our organisation. In fact, if someone isn’t experimenting with some crazy new idea and making mistakes, we encourage them to do so.

Co-dependent behaviour

Co-dependency is a term psychologists use to describe a person who is attracted to people who are addicted to a substance or some kind of destructive behaviour. To keep it simple, let’s say that you are the co-dependent and you are always finding yourself attracted to alcoholics. You may complain a lot about your alcoholic partner’s behaviour. You may criticise them and even beg them to change. But the truth is that you are just as addicted to this kind of partner as your partner is addicted to their drinking. In fact, if you are a true co-dependent, you would probably lose interest in your alcoholic partner the moment he or she got help and stopped drinking. And pretty soon you’d go out looking for another alcoholic to hook up with.

The co-dependents live in this closed circle of hating how they live but going back to the same pattern again and again. They believe that life is a constant struggle for survival, and of course it is, as long as they keep going back to their stuck, self-destructive patterns.

If you are a true co-dependent, you would probably lose interest in your alcoholic partner the moment he or she got help and stopped drinking

For most people, the employer-employee relationship is a co-dependent one. It is based on an addiction to survival thinking. The very thing employees and employers find most attractive is also the source of their downfall. In this case the paycheck is the addiction. Not that we don’t need money. We do. Back when we had an agrarian society we might have been able to trade potatoes for rent. But can you imagine trying to send the utility company five bushels of potatoes to pay your electric bill, or sending the bank three pigs every month to pay your mortgage?

Of course not.

Survival needs money

The point is that in the past 100 years, money has become almost as necessary for survival as air, water and food. In today’s world, money is synonymous with survival, and when survival is at stake, people get desperate. Out of fear they get hooked up with the easiest and fastest and most secure way to get those dollars in their pockets. They stop taking risks and they stop learning and they stop developing their own potential.

Despite the fact that money has taken such an important place in our society, our educational system still fails to address it directly. Like a stubborn co-dependent who won’t look at what he could do to free himself of his addiction to alcoholic people, the educational system refuses to look at what it might do to teach the actual principles of money, the ethics of money, and how money really works.

Despite the fact that money has taken such an important place in our society, our educational system still fails to address it directly

Sometimes it seems to me that our entire society is avoiding the subject. Even when we do talk about it, in school or on television programmes, we discuss it in sterile and lofty theoretical terms not put it in everyday terms that ordinary people can understand. And our educational system, which should be taking responsibility for teaching about money, continues to treat it as corrupting and evil. Don’t get me wrong. Money can corrupt. But the system seems to use that as an excuse to ignore that money is a cultural necessity in today’s world and can do a lot of good. To say that money is corrupting and evil in a world which runs on money makes about as much sense as saying that pigs or potatoes are corrupting in an agrarian society.

Job security is a myth

Our social system continues to promote the ethic that everything will turn out okay if you just study hard and work hard, if you will just do as you are told, don’t make waves, don’t make mistakes and memorise what you are told. God forbid that you would somehow learn to think on your own or take any real initiative. Our system encourages us to specialise, and to then go out and find a good and secure job.

Maybe a hundred years ago all this looked like a pretty good idea. But today there is no such thing as a secure job. In our rapidly changing world, the myth of job security is kept alive only by schools and businesses, both of whom know better, or should. Similarly, the idea of working your way to the top is obsolete. Too many times, we find ourselves climbing career ladders and getting almost to the top, before we discover that we’ve leaned them against the wrong walls and those walls are coming down.

Let me put it as simply as I can. Security is possible but it can’t be found in a particular job any more. The only way we can have security is through our own knowledge. We need to know how money works in our lives. We need to know how to be flexible and make changes when it is necessary. We need to know how to learn new skills and adapt quickly no matter what happens. In short, we need to learn how to be generalists first and specialists second, not the other way around as our present system teaches us.

Maybe a hundred years ago all this looked like a pretty good idea. But today there is no such thing as a secure job

Business schools are at fault too

When I say let’s learn about money, I’m not saying let’s learn to manipulate and exploit each other for the sake of amassing bigger and bigger fortunes. That’s just another form of addictive behaviour that in the long run isn’t going to help make any of us any happier or any more secure. Let me give you an example:

In the mid-70s, business schools began teaching MBA students to be take-over artists and so-called financial wizards. Instead of teaching them to be visionary business people who could create new goods and services to expand our economy, they were taught to exploit the system, which ended up actually shrinking our economy and creating problems for all of us. A lot of these take-over artists ended up in jail and the American people ended up with a multi-billion-dollar debt to payoff the damage that they did. This is co-dependency and addiction carried to its worst extreme!

Business schools are still teaching MBA students to make money with money, thus creating money managers instead of courageous business leaders. Getting bigger salaries and bonuses has thus become more important than the idea I am most interested in promoting here, that we can actually make an important contribution to our world even as we are getting rich. We can get rich and make a contribution only if we get out of our co-dependent relationship with money and really learn how it works!

Business schools are still teaching MBA students to make money with money, thus creating money managers instead of courageous business leaders

Think of the kind of world we could have if instead of teaching people financial co-dependency we began showing them how to create new products and services that the world needs. Why, we would be breathing new life into the entrepreneurial spirit that once made our country great, a spirit which at the moment seems to be dying a slow death.

Trained to be obsolete

Our greatest ally in all this could be our educational system. But, as everyone knows, that system is in deep trouble. Educators know it, parents know it and students know it. The system’s failure to respond to change is causing a revolt. In every major city public education is sliding into a state of anarchy, where nobody is really in charge. Students know they are being trained to be obsolete. They know that information necessary for their own survival is not being taught in schools. Most of them realise that the idea of working for one company all your life is ludicrous. In spite of this we grow up having the idea drummed into our minds that we should decide on a job or career specialisation in our teenage years. But just stop and think about it for a moment. How many of us have ended up training for jobs in companies or industries that weren’t even around by the time we graduated? We’re not talking about a handful of people here, we’re talking about millions.

Is it any wonder students often rebel not only against their schools but against society? They aren’t stupid, they’re bored. They look around them and they can see that what the society is offering through the schools really isn’t all that relevant. So they cut classes, drop out or simply have little interest. Most students make their way through our educational system for one reason, to get a diploma. They view a diploma as a way to open the next door. Sadly, all too many of them eventually discover that the years spent getting the diploma were a waste of time, with little gained. The doors they thought were there never materialise, and when they do they don’t necessarily open up just because you’ve got a diploma in your hand. And it’s not just high schools that are suffering in this way. Statistics show that there are more unemployed college graduates than ever before in history.

How many of us have ended up training for jobs in companies or industries that weren’t even around by the time we graduated

Shattered dreams

I meet all too many people who are sitting around wondering what happened to their lives. Their dreams aren’t even beginning to come true. Their incomes have hit a plateau and they know that at the rate things are going they will soon find themselves in their retirement years, dependent upon government assistance just to make ends meet. They see just a handful of other people gaining financial well being. As for themselves, they continue to work harder and harder while falling farther and farther behind. What happened to the promise of the good life? they ask themselves. After all, they followed all the rules society taught them—being good, doing as they were told, studying hard, working hard. What could have gone wrong? Well, what went wrong is that they learned, all right, but they learned the wrong lessons.

Unfortunately, most hard-working, promising students have been turned into co-dependent wimps by the time they graduate from high school or college. All they know is how to work hard and do as they are told, in spite of the fact that the job is no longer secure or doesn’t pay enough to keep up with the wildly escalating cost of living.

The only way to keep up with change is with knowledge. Our true wealth is found only in what we know. So many people I encounter in my work are still poor and struggling because they haven’t made enough mistakes in their lives. They have continued to hang onto the co-dependent relationships they were taught in school and that you should avoid making mistakes at all costs. And that belief keeps them imprisoned in their own ignorance more than any other single thing we are ever taught.

The only way to keep up with change is with knowledge. Our true wealth is found only in what we know

Instead of growing people who put their energy into avoiding mistakes, they become paycheck-addicts. Then reality strikes, usually around the age of 35. Suddenly they realise they either hate their jobs or are losing them because the skills they’ve developed have become obsolete. With the world crashing down around their ears, they simply don’t know where to turn. They don’t have any alternatives because they don’t even understand their own co-dependence or what it is doing to their lives.

But what about the boss? Unfortunately, this scenario also fits the heads of most companies. A company of co-dependent wimps never develops much real strength. In the end, the business loses profits and employees from the bottom to the top are left wondering why they were laid off or why they didn’t get raises when, after all, they played by all the rules for success that they were ever taught. Employees, as well as business owners, are finding themselves in this position, too, asking why, wanting to break out of their self-destructive co-dependencies and addictions but not knowing how to do it. Indeed, most companies which are suffering in this way can’t even imagine an alternative.

A new business model

Today, we’re beginning to see a new kind of business coming onto the scene. These successful new companies are either employee-owned or the employees pay to work for the company. I know it sounds absurd for employees to pay to work for a company, but it is already happening and seems to be a trend of the future.

The most successful new real estate companies are either employee-owned or the employees pay a fee every month to belong to the company. The old method of a real estate sales agent splitting a commission with the owner of the company, for example, is being phased out.

Today [in the United States], a real estate agent pays a fee to a company that advertises her or his services throughout the country, or at least through the area the person is working in. The individual salesperson is in business for him- or herself, however, getting the use of the company logo and benefitting from the widespread advertising. But the salespeople are responsible for renting an office, getting their own listings, working with their own customers, and processing their own papers. They pay their own phone bills, their own license fees, and even pay for their own for-sale signs.

Do you see the point I’m getting at here, that they are not just pay-check junkies, they’re not sitting on a stationary bike cranking away at the pedals? They are out there on the road, not just pedalling but steering, balancing and watching for traffic. They have responsibilities in every phase of the process that allows them to make a living.

With these new business structures the less successful salespeople are being phased out. It is a business of perform or perish. No more will the realtor-in-charge provide a desk and services in hopes that the salesperson can sell. The result is that employees are carrying the company rather than the other way around. And it’s working!

This trend of employees paying to work for a company is an idea that every business needs to look at. People want to make their own decisions instead of being dependent on a boss who controls the amount of security they have or the amount of money they make. Our company does it. Not only do my profits grow along with my employees’ earnings, but the people themselves bloom.

This trend of employees paying to work for a company is an idea that every business needs to look at

Our educational system, however, is still teaching people to ask, “Where is my paycheck?” Today, all of us are paying for an educational system geared to training people to be mindless robots who end up working themselves into a corner of economic co-dependence and obsolescence, with no personal wealth of any kind, neither viable skills and knowledge, nor money. They remain addicted to the steady paycheck because they don’t know how money is generated.

How we all pay for our inadequate educational system

1. Business and government leaders who cannot think. Our business schools create MBAs who are creative in accounting so that a business can look good on paper even when profits and growth are diminishing. They offer training in the art of finance and acquisition, which when put into actual practice causes stock prices to jump and then crash. An MBA degree is often a ticket to the top, allowing people to avoid essential work experience. These new leaders lose touch with employees as people, and business becomes an accounting job. The company’s ‘’bottom line” becomes the sole concern and people are treated as little more than troublesome but necessary resources.

2. Exploitation of Resources. Western business only believes in what it can see, touch, smell and taste. It thinks only in terms of tangible objects such as land, oil, gold, trees, crops, machinery, etc. Western society teaches only about the visible. It almost ignores the invisible, those less tangible aspects of our lives such as morale, motivation, self-esteem, trust, the spirit of a group when they are working well together. It has yet to develop a way to teach people how to make use of the invisible world, which is infinitely greater than the visible world.

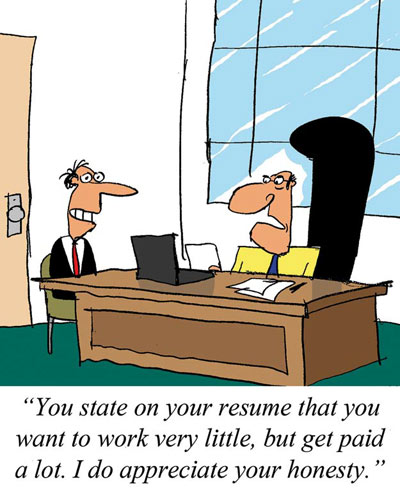

3. A nation of co-dependent wimps. More and more people blame the government for their problems. And increasing numbers of people spend all their spare time submitting their resumes to other companies, always in search of a better job and benefit package. I overheard a woman in a restaurant gloating to her friend that she had quit her job with a company that was going broke and had gotten a job with the state government for more pay, a better benefits package and less work. On top of that, she was happy because she said it was almost impossible to get fired from the government, so she could just coast along and still have greater job security. And we wonder why our tax burden goes up while less and less gets done! Everyone seems to be looking for a job with more pay and less work.

3. A nation of co-dependent wimps. More and more people blame the government for their problems. And increasing numbers of people spend all their spare time submitting their resumes to other companies, always in search of a better job and benefit package. I overheard a woman in a restaurant gloating to her friend that she had quit her job with a company that was going broke and had gotten a job with the state government for more pay, a better benefits package and less work. On top of that, she was happy because she said it was almost impossible to get fired from the government, so she could just coast along and still have greater job security. And we wonder why our tax burden goes up while less and less gets done! Everyone seems to be looking for a job with more pay and less work.

4. An education that fails those who need it most. Since we punish those who don’t do well in school, they often drop through the cracks and are ignored by the system. When you tell them to get a job that will only keep them at or below the poverty level, the sense of self-worth diminishes. And when a person’s sense of self-worth goes down, the desire and ability to work decreases too. Through this system we literally create hundreds of thousands of welfare-dependent families and people who have no hope for a better life. Under these circumstances, crime increases. As Jesse Jackson commented during the Los Angeles riots in 1992, in an environment of terrible poverty and hopelessness, going to jail is actually an improvement over the life they know. They’ve got nothing to lose and everything to gain by committing a crime.

You see, when you start looking at all the factors, you begin to see that every-one would have a lot to gain if we were to teach everybody about money and how it works.

Henry Ford’s real wealth

There’s a little story about Henry Ford that I like to relate when I’m telling people about money and the value of the invisible. As you know, Ford was a multi-millionaire at a time when a million dollars was still a lot of money. Someone once asked him what he would do if he lost everything. Without a pause, he replied, “I’d have it all back in less than five years.” How could he have done that? He could have done it because he knew that his real wealth wasn’t counted in how many dollars he had in the bank, or even in the number of factories or the amount of real estate he owned. His real wealth was in what he had between his ears: the intangible, the invisible, the knowledge he had about what money is really all about. For all their emphasis on knowledge, our schools most neglect this kind of resource.

henry ford’s real wealth was in what he had between his ears

Until our educational system stops punishing people for making mistakes, and until the creation of money is made a part of the school curriculum, people will continue to live lives as co-dependent wimps. They stop growing and stop thinking until the only question they know how to ask is, “Where is my paycheck?”

Is money evil?

The first lesson we absolutely must learn is that money itself is not evil. It is simply a tool, just as a pencil is a tool. A pencil can be used to write a beautiful love letter or a memo firing someone from a job. While a pencil is designed to write with, it can also be used as a lethal weapon to stab a person in the eye. The thing that makes the difference isn’t the object, but the motives of the person holding the pencil—or handling the money. I like what Reverend Ike, my Southern Baptist preacher friend, says: “It is the lack of money that is the root of all evil.”

The first lesson we absolutely must learn is that money itself is not evil. It is simply a tool, just as a pencil is a tool. A pencil can be used to write a beautiful love letter or a memo firing someone from a job. While a pencil is designed to write with, it can also be used as a lethal weapon to stab a person in the eye. The thing that makes the difference isn’t the object, but the motives of the person holding the pencil—or handling the money. I like what Reverend Ike, my Southern Baptist preacher friend, says: “It is the lack of money that is the root of all evil.”

We cannot afford to keep people ignorant about this subject any longer. Money is a tool of business—and what activity is not associated with business in some way or another? Churches, charities, computer companies, governments, music stores, museums, schools, weapon manufacturers, sports teams, family homes… the list goes on and on… are all businesses. Money comes in and money goes out; whenever that occurs, we’re talking about business. I know many people who hate business and everything it stands for. But these feelings are nothing more than the byproduct of our confusion and ignorance about money—certainly not our knowledge of it.

We need to probe a little. Why does our educational system do such a poor job of teaching us about money? Why did our teachers resist teaching about it, and why are our children’s teachers still resisting? Why do people who should know better continue to support the old myths that there is something inherently dirty about money? Could it be that the people running the schools have never learned about it themselves? If that’s true, we desperately need to make some changes. Directly or indirectly, our continued ignorance about money is causing long-term damage to generations of people.

Poverty—the real root of all evil

Just imagine what kind of world this would be if everybody understood money, if there was no longer any confusion and desperation about it. We’d have less crime—less street crime as well as less white collar crime in business and government. All crime, white collar or the street kind, diminishes everyone’s well being, ultimately creating more desperate people, then filtering down, creating more street crime. We build more jails with our tax money. Jails mass-produce smarter criminals since prison is merely a ‘graduate school’ for the advanced study of crime. Is it possible that if we started educating young children about money, we would have fewer criminals in jail and less crime and greed in business and government?

If we got past the false belief that there is something basically dirty or evil about money, and we began educating children regarding its real meaning and purpose in all our lives, within 30 years we would have a more financially secure nation, better-run governments and businesses, fewer people dependent on government handouts and a much stronger national economy.

Reordering priorities of education

Let’s never forget that the first priority of public education is to teach people to master the basic skills necessary for functioning well in society. If we fail to do that much, there’s something seriously wrong with the system.

Where do we begin rebuilding our society so that our dreams of one day being rich and happy can come true? The answer is really quite simple. We begin by redefining money, not as the root of all evil but as a basic instrument that every schoolchild must thoroughly understand before he or she reaches the sixth grade. To keep our young people ignorant about money in today’s society makes about as much sense as failing to teach young people in an agrarian society how to till the soil, plant their crops and bring in the harvest.

This single correction of our basic perceptions about money can do wonders. Not that our responsibility ends there—far from it! But with this change of mind we open doors to a whole new world of possibilities, a world no longer divided between the haves and have-nots. We cannot call ourselves a responsible society until we can honestly say that we are doing our best to understand and teach the principles of money. And that education starts with this simple change of mind—that ignorance about money is the real evil we must fight, not money itself.

Adapted from Be Rich & Happy by Robert Kiyosaki; Published in India by Jaico Books; Reproduced with permission.

Spot an error in this article? A typo maybe? Or an incorrect source? Let us know!

Spot an error in this article? A typo maybe? Or an incorrect source? Let us know!